He’s finding some fabulous bargains on Amazon but has not been downloading the right paperwork to allow him to recover the VAT on his purchases. We have stepped in to ensure that he does not miss out.

Let’s look at the Amazon process in more detail.

Amazon Account Names

In this case, the buyer is Cameron the VAT registered sole trader – the Amazon account is in his name. Amazon accounts are easy to edit so he could change his account name to Cameron D – Photography. This would ensure invoices were made out to his business name.

If he wanted multiple people in his business to be able to order on his behalf, or if he simply wanted to keep his business and personal spends separate he could set up an Amazon Business Account.

This would allow him to add his business VAT number so he would not be charged VAT on any EU supplies and the invoices would be in his business name.

Retrieving VAT Invoices

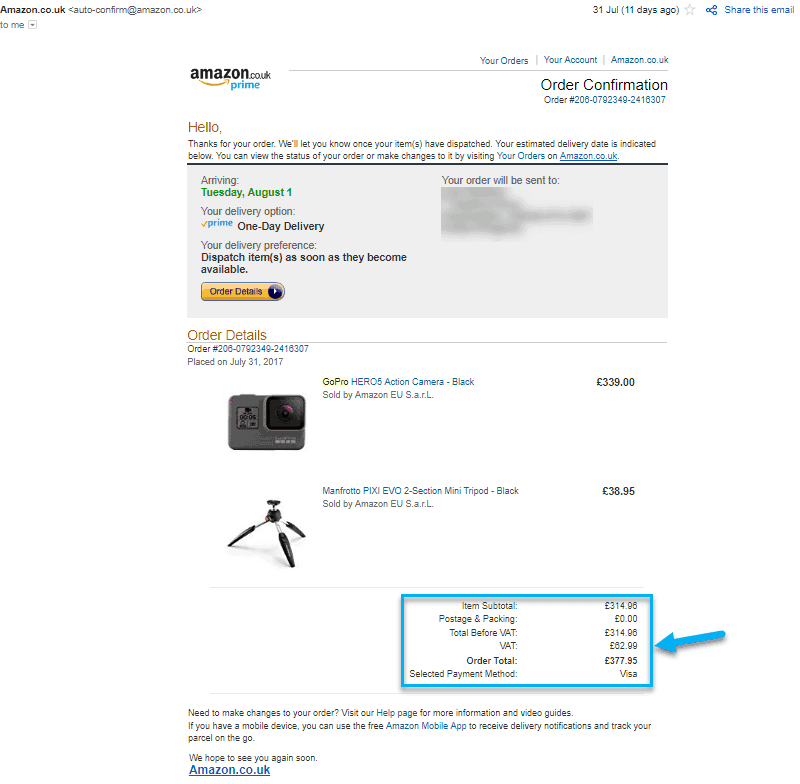

Cameron placed the order for his shiny new GoPro in July, once the order is placed he would have received an order confirmation by email.

- Although the order confirmation does include the £62.99 that he will pay in VAT, the order confirmation is not a VAT invoice and will not be accepted by HMRC as evidence that he has bought the goods.

- Orders can be placed and cancelled or changed before any money changes hands.

- Orders won’t have the supplier VAT number on which we know we need for HMRC to accept that we have paid VAT on our purchase.

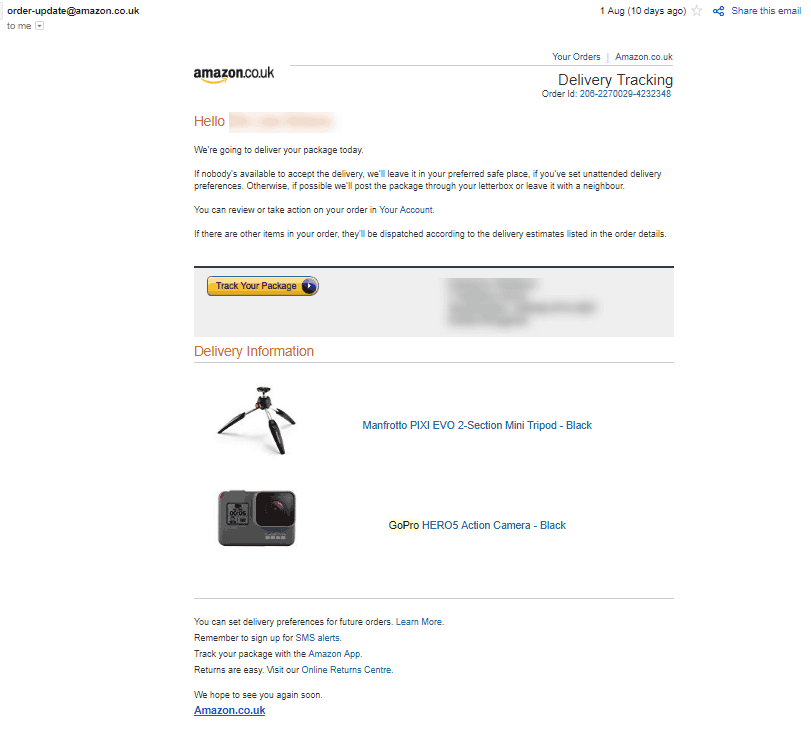

Once Amazon dispatches the goods, they will tell you that your order is out for delivery. This only confirms that the order is on its way to you. The delivery tracking advice has no financial detail included and is also not accepted by HMRC as proof of purchase for VAT purposes.

You won’t see a copy of the invoice when you receive your delivery, they don’t come with the package!

Once the order has been delivered you will be able to log back into your Amazon account and find your invoice.

If you order has been fulfilled by Amazon, you will be able to access your invoice online by clicking on the invoice button in the right-hand corner of the order.

You will now be able to download your Amazon invoice. The invoice has all the details that HMRC require for you to recover the VAT on your purchase.

- The name and address of the seller – Amazon Uk

- The name and address of the buyer – Cameron Dickson, the VAT registered sole trader

- The sellers VAT number

- Date of the invoice

- Full VAT details of the charge applied to the invoice.

If the goods were shipped by an Amazon Marketplace seller, then you would need to request a copy of the VAT invoice from the seller. Most Marketplace sellers will respond within 2 working days. Don’t forget to ask them to invoice the VAT registered business so that they produce the invoice in your business name.

It can be quite a time-consuming process if you are a frequent Amazon shopper but is probably worth the time spent if you are VAT registered.

Amazon Business

Finally – if you do find that your business and personal accounts are overlapping you can set yourself up with a business account and separate your business and personal Amazon spends. If you have Prime on your personal account you can share the Prime membership with your business account so you don’t have to pay another fee.

See : Amazon Business Account.

Caseron Masterclasses

If you'd like to take a deeper dive into this topic, take a look at our bloody brilliant business expenses masterclass.

This masterclass covers the A-Z of business expenses. Learn which expenses can be put through your business, which are tax-deductible and which are not. Understand different accounting treatments for limited co and sole trader entities.

If you would like to get access to all of our Masterclasses, tutorials, workbooks, checklists and cheatsheets - our PROFIT HACKERS membership club is for you!